| A warning from Lyn Alden…

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | | | Lyn Alden:

Growing Concern

For Treasurys

| |

Lyn Alden — one of today’s most insightful analysts — has just issued a report detailing important issues for U.S. Treasury liquidity, debt loads and rising interest rates.

| | | |

I’m proud to say I was one of the first to jump aboard the Lyn Alden bandwagon.

|

After nearly 40 years in this business, I’ve seen it all and read analyses and predictions from everyone. And I can tell you that Lyn is one of the best I’ve ever come across.

Thus, just as she was bursting onto the scene in 2020, I secured her as one of the keynote speakers for our virtual New Orleans Investment Conference that year. She also presented the following year, although a scheduling conflict prevented her from participating in this year’s recent conference.

|

I think Lyn’s absolutely brilliant…and perhaps my opinion is somewhat shaded by the fact that her views echo many of mine.

|

So here’s why I’m writing you today…

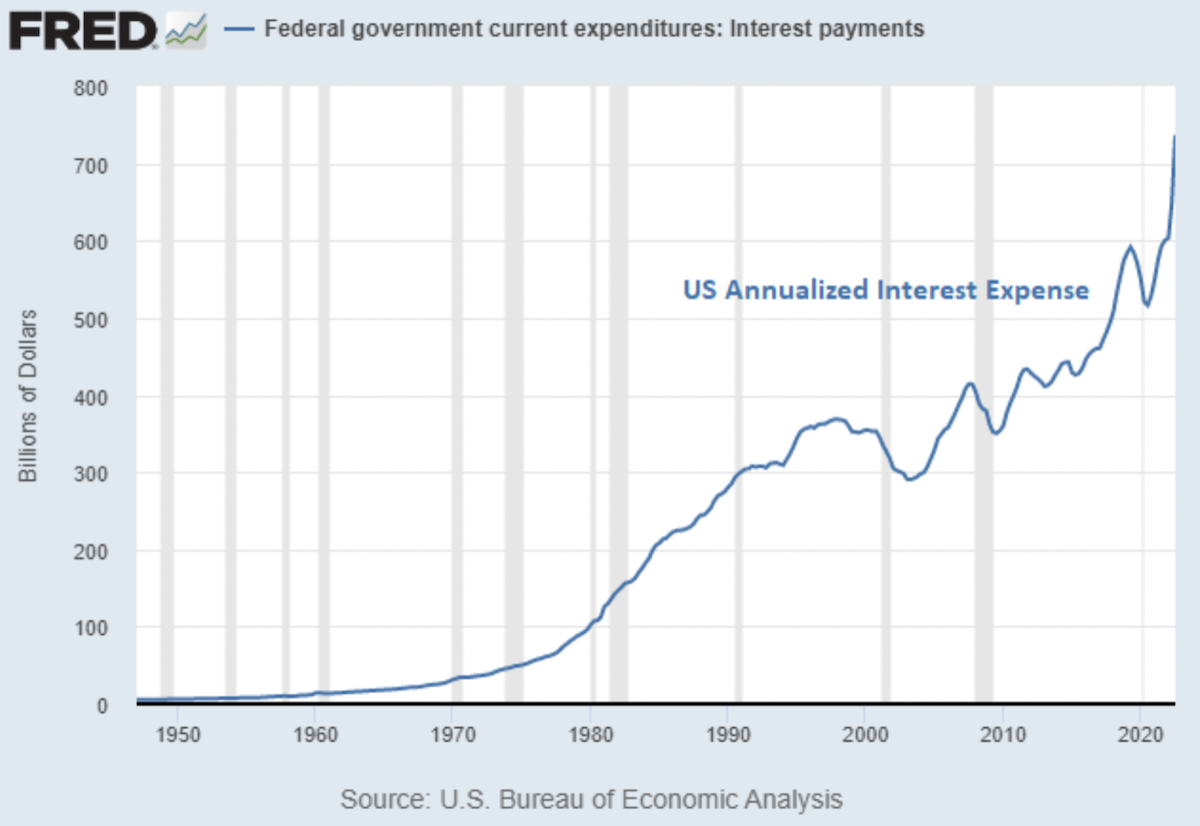

Lyn recently issued her November letter, which features a chart that you’ll be familiar with:

|  | |

I’ve featured this same chart over the last month since the BEA updated it for their initial third-quarter estimate. It shows how the Fed’s steep interest rate hikes have just begun to impact the cost of servicing our massive federal debt, recently hitting the annual rate of $736 billion.

But that trend line is reaching for the sky, and I predict that it will soon exceed $1 trillion — a number that I believe will create significant political headwinds for the Fed.

In her just-released report, Lyn agrees that this is a big and growing problem…but also highlights an emerging liquidity issue in U.S. Treasurys. As she puts it,

|

“As the Federal Reserve has aggressively raised interest rates, the foreign sector has stopped buying, banks have stopped buying, and the Fed is selling. The result has been unusually high levels of volatility and illiquidity in the Treasury market.

“Treasuries historically are supposed to be safe, highly-liquid investments. This means that the risk of loss tends to be low in any given year, and even if the largest buyers or sellers in the world want to change their position size, it won’t influence the market much. But 2022 has been terrible for performance, volatility, and liquidity in the Treasury market….

“….In the intermediate term, it’s the lack of liquidity, rather than the high interest rates, that are the more acute problem for the Treasury market. The fact that large entities can’t buy or sell large amounts of Treasuries without moving the price, and the fact that there isn’t enough buyers to offset these structural sellers, is a growing problem.

“In the long-term, as we look out a few years, the interest increasingly looks like a problem. Rising debt levels relative to GDP, large structural deficits year after year, and with flat-or-rising interest rates on those rising debts, will contribute to an inflationary fiscal spiral that will eventually require Federal Reserve intervention in order to monetize fiscal deficits despite above-target inflation.”

|

As you know, I’ve made the same predictions…and pointed out how tremendously bullish such a situation would be for gold and other tangible assets.

|

But note that these comments merely scratch the surface of what I believe is one of the most important analyses I’ve seen in years.

|

Using a number of compelling charts, Lyn’s letter reviews the history of the U.S. debt issue (or non-issue, as it was when interest rates were low) and clearly explains the sea change now facing us.

I urge you to click on the link below to read Lyn’s full report now.

| All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

|

CLICK HERE

To Read The Latest Edition Of

The Lyn Alden Investment Strategy

| | | | |

© Golden Opportunities, 2009 - 2022

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |