| Was that the bottom in gold? | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

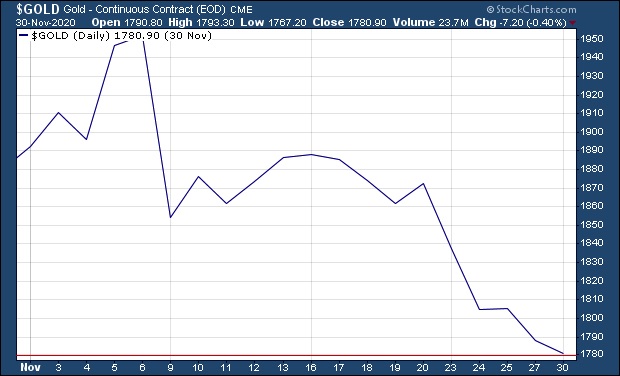

Gold investors have been on the ropes for weeks, taking their beating and waiting for the bottom.

With gold soaring today off of a major support line, the question of the day is, “Was that the bottom?”

|

|

Thankfully, we can say goodbye to November — and possibly the gold correction.

|

The yellow metal had been dropping consistently, and sometimes precipitously, through November. It fell through Fibonacci support levels marking a 23.6% retracement, then 38.2%.

|

|

After each big drop, it “felt” like a bottom was coming. But alas, it wasn’t to be. Then came the next big line of support — the 50% retracement line at around $1,775, which marked a give-back of half the gains from the lows in March.

While not officially a Fibonacci number, a 50% retracement is often used by experienced traders. Our friend Dennis Gartman famously referred to this area as the “box” marking a sufficient correction in any major rally, and therefore a great entry point.

The nature of today’s fast-money markets, dominated as they are by hot trading flows, means that these support levels often become self-fulfilling prophecies. In other words, they’re targets for traders looking for support levels and trying to time entry points.

So it was that gold took another big fall last Friday, dropping $22 to about $1,788. Then, yesterday, it dropped again…then rallied to peak into the green…but then was quickly forced lower to close down $11.50.

The ending level? On a spot basis, $1,776.20.

|

Apparently, that was close enough to the 50% retracement target to open the floodgates for traders to get back into gold today. The metal immediately soared out of the gate, confirming the previous day’s support level and encouraging more traders to come in.

|

The result? So far, a gain of about $30, back well into the $1,800s.

So was yesterday the bottom? We’ve been fooled before, but never with as much evidence of a new rally as we have right now.

As you know, I’ve been predicting that gold would likely repeat the experience of the last five years or so, wherein it typically bottomed in mid-December — around the time of the Fed’s year-end meeting or a few days afterward.

We have seen it mark the lows a little earlier, most notably in 2019 when the bottom came in October. So a bounce off of support on the last day of November wouldn’t surprise me. Likewise, another probe downward, or a retest of yesterday’s lows, would not be shocking either.

| | Golden Opportunities continues below... | SPONSOR:

Micro-Cap Exploration Company

Hits High-Grade Gold Zone

Rover Metals Corp Drills 32 Meters Of

Continuous Gold Averaging 13.6 G/T

Judson Culter, CEO at Rover Metals, states “Our preliminary geological modelling suggests that the ‘DDH 86-28 to CL-20-01 to CL-20-08 to DDH86-19’ quadrant at Bugow is a conceptual high-grade ore body that needs to be drill tested at depth….The Summer 2020 drill confirmation of our exploration approach generates new targets not only within the Bugow zone, but also within the other historic showings on the property (the Beaver Zone, Andrew South Zone, and the Andrew North zone). We also now have opened the door to several greenfields targets on the project.”

CLICK HERE

To Get The Full Details | | |

It’s important to note that the mining equities never confirmed the deepest, most recent gold sell-offs (the major indices were actually up yesterday)…and have already responded with gusto to today’s gold move.

If this is in fact the bottom for gold — and even if that bottom is retested sometime this month — the gold stocks are likely beginning a rebound that will last well into next year.

History has shown that a very significant portion of the high-quality junior resource stocks double or more from their late-year bottoms to their levels in the January-April time frame.

Some, of course, will multiply three, four or more times in price.

But the key is to buy near the bottom…and that window of opportunity seems to be closing right now.

Frankly, the best way to take advantage of this opportunity is to make sure you’re subscribed to Gold Newsletter.

|

Our year-ending expanded issue of Gold Newsletter, featuring my top bargain-basement stock picks…coverage of many of our recommended companies…

…And highlights from our recent New Orleans Investment Conference (with insights from dozens of the world’s top experts) is going to be issued next week.

|

If you subscribe now, you’ll get that blockbuster issue — which all by itself is worth the entire cost of a year’s subscription.

Time’s a wastin’, and this opportunity won’t last long. I urge you to get next week’s big year-end issue of Gold Newsletter…and a full year of coverage as these junior mining stocks embark on their next leg upward…by CLICKING HERE.

| All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

| | | |