|

Dear Fellow Investor,

When chronic conditions like obesity, diabetes and hypertension aren’t consistently monitored and kept under control, traumatic (and expensive) health care crises often result.

Solutions that can alleviate the dangers and expenses of these chronic conditions can save enormous sums to the health care system...and save lives.

This is why large health care payers like Medicare and Medicaid increasingly provide significant incentives to providers that manage chronic conditions and keep patients out of hospitals.

It’s an environment tailor-made for an upstart technology company with ground-breaking technology that addresses today’s most challenging chronic health issues.

Suffice to say that Reliq Health Technologies’ remote patient monitoring (“RPM”) and chronic care management (“CCM”) products and services are in the process of changing how modern medicine addresses these problems.

And in the process, Reliq’s shareholders stand to do very well...by doing good.

You see, led by its iUGO Care monitoring service, Reliq’s products give clinicians the ability to provide remote care to patients with multiple chronic conditions.

Overcoming The Challenges

Of Chronic Conditions

There’s no denying that the combination of a population that is both rapidly aging and increasingly overweight has created an explosion in the number of people with multiple chronic conditions.

It’s become a crisis — one that the Centers for Medicare and Medicaid Services (“CMS”) is trying to get a handle on by incentivizing clinicians to provide proactive care in the home.

The hope is that by using services like Reliq’s iUGO Care monitoring system, clinicians can prevent many of the complications that lead to costly hospitalizations and ER visits.

The U.S. Centers for Disease Control agency notes that chronic conditions are the leading drivers of the $3.5 trillion the U.S. spends every year on health care.

With numbers like that, it’s easy to see why the government has dedicated more than $20 billion to reimbursement for RPM and CCM services like the ones Reliq is delivering right now.

An Effective, High-Margin Service —

That The Government Actually Pays For

Indeed, the CMS considers the issue such a priority that in January 2019, it introduced new billing codes to cover remote patient monitoring: Setup, Equipment and Monitoring Services.

CMS billing codes aren’t typically the kind of information that would raise an investor’s heart rate, but in this case, they’re critical to the demand for Reliq’s iUGO product.

• CPT Code 99453 (Initial Setup) pays approximately $21 per patient

• CPT Code 99454 (Device/Transmission Fee) pays approximately $69 per patient per month

• CPT Code 99457 (Monitoring and Treatment) pays approximately $53 per patient per month.

The CMS has demonstrated a willingness to reimburse for these codes. That means Reliq’s’ clients can justify iUGO’s Care subscription fees — given the product’s current fee structure, it can be a very significant money maker for Reliq’s clients.

In addition to the codes above, in several states, including Texas and Indiana where Reliq has a client base, Medicaid reimburses home health agencies up to $10/day (~$300/month) for RPM, making Reliq’s iUGO Care platform a very profitable addition to a home health practice.

Depending on the data services those clients request, iUGO Care’s subscription fee ranges between $15 and $50 per patient per month. The average charge is $25 per patient per month.

Reliq’s current client base consists of home health agencies, adult medical day cares, physician practices, skilled nursing facilities, employer-sponsored insurance plans and the U.S. pharmacy network.

More clients brings more patients...and that brings in more revenue for Reliq.

The company currently operates in 15 states, as well as Australia and Canada, with iUGO Care providing clients with reimbursable RPM, CCM, telemedicine and wound care services.

New Products And Services

To feed the data that drives iUGO Care’s services, Reliq offers iUGO Home — products that bring healthcare directly into the patient’s home. These include:

• iUGO Home Hub: This product provides a hub to wirelessly connect all devices and facilitate telemedicine visits.

• iUGO Home Watch & Pendant: These products offer wearable, on-demand care with features like an SOS emergency button, fall detection, medication reminders, geofencing alerts, two-way audio and video and direct access to a 24/7 call center.

The call center itself is another piece of Reliq’s business model.

Located in Port Saint Lucie, Florida, the center’s staff has extensive experience working with health plans, clinicians and patients.

Their knowledge of CMS compliance requirements provides care providers with the peace of mind that their use of iUGO products and services will be reimbursable.

Explosive Growth Planned In 2020

With its business model firmly established and CMS on board to provide clinicians and healthcare providers with a steady revenue stream from iUGO care, Reliq Health Technologies is set up for a year of super-charged growth in 2020.

Just since July, the company has signed 32 new contracts and will be aggressively pursuing new states and new market segments in the new year.

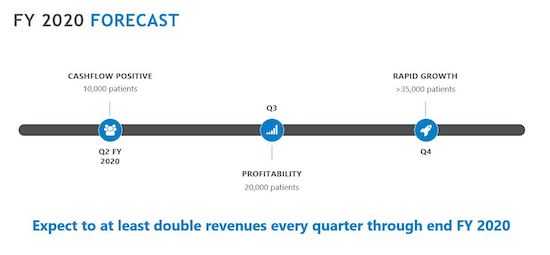

Consider this: Management expects to at least double revenues every quarter through the end of its fiscal year 2020. By the second quarter of fiscal year 2020, it expects to be cash-flow positive and serving 10,000 patients.

And by the fourth quarter of its fiscal next year (i.e. June 30, 2020), Reliq expects to be serving more than 35,000 patients.

Thanks to recent warrant and option exercises, Reilq believes it can reach profitability without having to tap the equity markets.

That means investors who jump on this story now will have a chance to ride the steepest part of Reliq’s growth curve next year.

If you believe the trends in chronic conditions will continue to drive demand for solutions like iUGO Care, you’ll want to own a piece of Reliq before it takes the market by storm in the weeks just ahead..

CLICK HERE

To Learn More about Reliq Health Technologies

|