|

Dear Fellow Investor,

Whatever one’s position on climate change, there’s no doubt that there’s a huge market out there for low- or zero-emission transportation solutions.

The electric vehicle revolution, sparked in part by the hip cachet accorded to the sector by Elon Musk and Tesla, has the potential to transform the transportation market.

In the process, it will prime demand for the metals used to make the batteries that drive these vehicles. Key among those metals is cobalt, a specialty metal that serves to make rechargeable batteries more stable and efficient.

Lately, there’s been talk, by Elon Musk, among others, about reducing or eliminating cobalt from EV batteries. Most experts are skeptical, however, as decreasing the amount of cobalt in a battery has a negative impact on its number of charge cycles and overall stability.

Given that even the least cobalt-intensive batteries will use at least a few kilograms of the metal, an EV-driven market for the metals appears likely to drive prices in the medium- and long-terms.

An Essential Component of Lithium-Ion Batteries

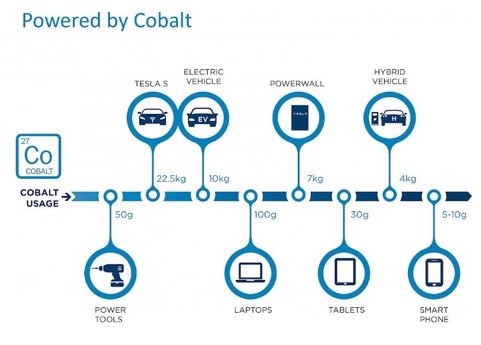

A look at this chart of cobalt intensity by end use gives you a sense of why cobalt stands to play a key role at the EV revolution rolls on.

Source: www.globalenergymetals.com

Prior to the recent surge in demand for EVs, the primary battery use for cobalt was consumer electronics and power tools. As you can see from the graphic, those items' batteries use an amount of cobalt measured in grams.

By contrast, the hybrid and pure electric vehicles that have come onto the scene use between 4 and 14 kilograms of the metal per vehicle. And, as you can see, a Tesla Powerwall electricity storage battery uses 7 kilograms of cobalt per unit.

The tension between the cobalt intensity of the current slate of lithium-ion batteries and the desire of automakers like Tesla to reduce dependence on the metal has had an impact on cobalt prices recently.

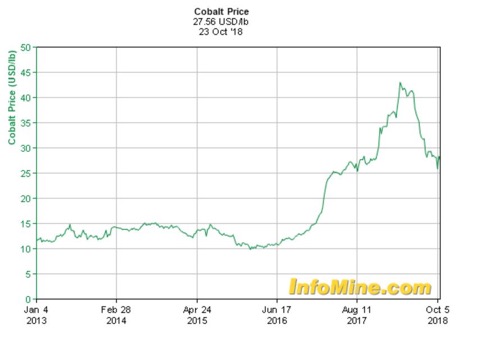

As the following chart demonstrates, after increasing precipitously in price from 2016 into early 2018, cobalt’s spot price has dropped quite a bit in recent months, although it has stabilized of late.

The stabilization likely relates to the market realization that there is a limit to how much end users can reduce cobalt content in batteries and maintain performance.

Supply Dominated By The DRC

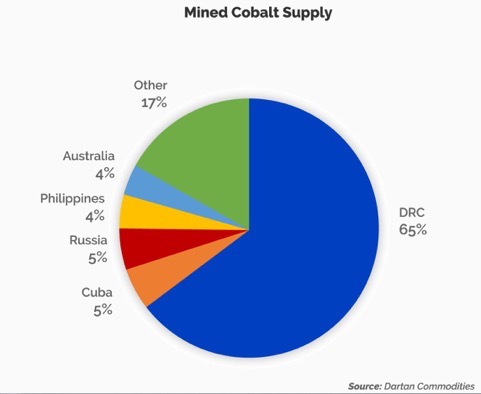

A key component of the cobalt story is the fact that the Democratic Republic of Congo (“DRC”) dominates the supply side of the picture. In 2017, the country produced 65% of the world’s supply of the metal.

This country-centric supply story is of particular concern because the DRC has a war-torn history and a reputation for using child labor to mine for metals, including cobalt.

Another issue common with resource-rich third-world countries and for which the DRC is certainly not immune is that, as prices for a commodity rise, governments frequently renegotiate deals and/or nationalize projects. In fact, the DRC just announced that, in response to rising cobalt prices, it is ignoring previous agreements and tripling the royalty on cobalt production to 10%.

If prices keep rising, you can bet that it won’t stop there.

Another issue: Since most cobalt is produced as a by-product of copper or nickel mines, its production is influenced heavily by the global economy, which drives demand for both metals.

Fears of supply disruptions, combined with a desire to avoid the bad public relations of depending on the DRC, have made EV manufactures skittish about cobalt as a battery component.

As investors, that skittishness creates opportunities to place bets on companies with potential cobalt resources in more stable jurisdictions. Because of the by-product nature of cobalt, pure play cobalt stories are relatively rare, a fact which makes them all the more valuable.

Cobalt Prices Likely To Remain High

While cobalt prices have taken a tumble in 2018, the long-term price outlook is bullish. The steady threat of supply disruptions from the DRC combined with the increased demand from the EV revolution will make cobalt an in-demand commodity for the foreseeable future.

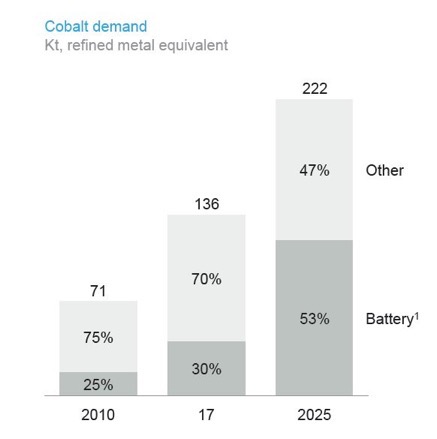

The graphic below from McKinsey predicting future cobalt demand tells a compelling story:

The consulting firm expects annual cobalt demand to grow from 136 kilotonnes of refined metal equivalent in 2017 to 222 kilotonnes by 2025. Note too, that the percentage of cobalt use by end use will grow from 30% to 53% for batteries.

This increase in end-use will come even as the industry is seeking to reduce the amount of cobalt — and increase the amount of nickel — used in lithium-ion batteries. More nickel means greater energy density, but unfortunately also brings about greater instability. Cobalt’s key benefit is increased stability.

If we don’t want our batteries bursting into flames or exploding, we’ll need a significant contribution from cobalt for the foreseeable future.

Still, researchers are working hard to perfect the delicate nickel-cobalt dance, and it seems likely that cobalt usage per battery will decrease some. But the projected demand curve for lithium-ion batteries in general is so steep and consistent that demand for cobalt will continue to place severe strains on global supplies.

How To Play the Trend

Overall, the timing to place bets on cobalt is excellent.

This year has seen the market return to earth, from prices over $40/pound to just under $30/pound. Many analysts are predicting that cobalt’s market dynamics will again send the metals north of the $40/pound mark.

In scanning the universe of cobalt plays, the companies that stick out are those with cobalt-heavy projects in politically safe jurisdictions. Unfortunately, these are few and far between.

The vast, vast majority of cobalt companies in today’s junior resource markets are either outfits focused on marginal land plays in historic cobalt districts or companies more concerned with getting out news releases than drill results...or both.

In fact, we currently feature only one “cobalt play” in the Gold Newsletter portfolio: Trilogy Metals (TMQ.NYSE-A; $2.21).

Trilogy Metals controls two large, polymetallic projects in north-central Alaska that have been valued almost exclusively for their high-grade copper resources. Through a re-assessment of historical drill core from its Bornite project, the company recently outlined a 77-million-pound cobalt resource.

While the cobalt resource will represent only a fraction of the total value of Trilogy’s projects, it will add considerably to their economics and does offer significant exposure to the cobalt price.

As the global scramble for scarce cobalt resources continues to intensify, such projects should attract more than their fair share of investor attention. We’ll continue to search for smart plays on cobalt to feature in Gold Newsletter as the EV revolution rolls on.

And stay tuned for more in our series of special reports on energy metals and the companies exploring for them.

|