| Midas touch investor makes his latest move in gold

| | Please find below a special message from our advertising sponsor, West Red Lake Gold Mines. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports.

| | Contact Us | Privacy Policy | View in Browser | Forward to a Friend

| |  | | Midas Touch Investor Makes His Latest Move In Gold

| | | Legendary Canadian investor Frank Giustra became a billionaire largely by investing in gold and gold stocks at the right time.

After a period out of the market, in 2023 Giustra formed a team to buy a distressed gold mine in Ontario’s high-grade Red Lake district.

The result: West Red Lake Gold Mines (WRLG.V; WRLGF.OTC), a company with the project, the team and the financial backing to put it on the “golden runway” for investor profits.

| | | | Frank Giustra has an indisputable knack for timing the gold market.

| | After a successful early career as a stockbroker for, and eventually as the chairman of, natural resources trading firm Yorkton Securities, he left the industry in 1996 to found Lionsgate films.

The gold industry would spend the late 1990s in one of the worst slumps in its history.

Then, in 2001, with gold prices trading below $300/oz., Giustra returned to the market (just before the big rally of the 2000s) by becoming the chairman of mining financier Endeavour Financial.

Companies he founded during that period included Endeavour Mining, Wheaton River Minerals and Wheaton Precious Metals. Those companies would go on to be wildly successful.

Then, in 2007, just before the Great Recession kicked in, Giustra stepped aside again to pursue philanthropic efforts.

|  | | Billionaire investor Frank Giustra made his fortune mainly by being in the

gold market at the right times.

| | Now, he’s back in the mining game, having put together the financing and the team in 2023 for West Red Lake Gold Mines (WLRG.V; WLRGF.OTC).

| | As you’re about to see, it’s a case of great timing once again, as West Red Lake Gold Mines has taken over a distressed, but high-grade gold mine.

| | And it promises to be the keystone in Giustra’s next big win for shareholders — because the company has the resources, the personnel and the plan to put this mine back into profitable production, just as gold is again in a bull run.

| | Giustra Swoops In On A High-Grade Gold Mine

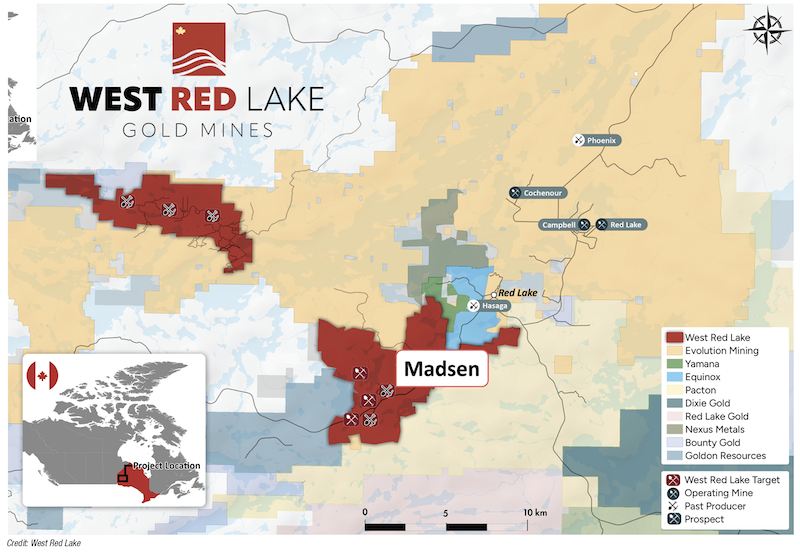

| | As the company’s name implies, West Red Lake’s core asset, the Madsen Mine, lies on the western end of the Red Lake gold district in northwestern Ontario.

The district is one of the highest-grade gold regions in the world, having produced more that 30 million ounces from high-grade gold zones.

Madsen was a mine that had produced two million ounces of gold in its past and had, in the past seven years, seen previous owner Pure Gold do the hard, capital-intensive work of putting the mine back into production.

| | At one point, just before it started to mine at Madsen, Pure Gold sported a market cap of $750 million.

| | But then the reality set in that its resource model for the mine was insufficient and the build-out undercapitalized. Pure Gold was forced to close the mine in October 2022 and apply for creditor protection.

Then, in early 2023, Giustra formed a group to swoop in and buy the distressed asset for less than $35 million total and just $4.6 million in cash.

| | A Fully Permitted Operation With

$250 Million Of In-Place Infrastructure

| | The team he put together included West Red Lake Gold’s President and CEO Shane Williams, an industry player with deep experience developing and putting mines into production.

Armed with capital and a clear game plan to refurbish Madsen, Williams and team have spent the past year and a half putting about $50 million toward a planned 2025 re-start.

As investors, the great news with this project is that Pure Gold has already spent $250 million on mining infrastructure at Madsen, and the mine is already fully permitted.

A prefeasibility study on the mine restart is due out within a month and West Red Lake recently announced a $48 million finance package that fully funds the restart and ramp up of the mine.

| | Room To Grow Resources In

The Uber-High-Grade Red Lake District

| | Madsen already boasts a global resource of two million ounces (1.65 million indicated and 366,200 inferred).

It also has all kinds of room for expansion, both on the underground mine site itself and elsewhere on the property.

|  | | Click image to enlarge

The Madsen Mine lies near the heart of the uber-high-grade Red Lake Gold district and has tons of exploration upside.

| | Red Lake systems have deep roots, with mining in some cases occurring all the way down to the 3,000-meter level so far.

| | Better still, the grades often improve with depth...and Madsen has only been outlined down to the 1,300-meter level.

| | As the company goes about prepping the underground infrastructure there for mining, it will have the opportunity to drill Madsen’s deeper targets in a cost-effective way.

| | Entering The Golden Runway For Investor Profits

| | With the prefeasibility study on the way and the money in the bank to put Madsen back in production in 2025, West Red Lake Gold Mines is entering the “golden runway” for share price performance.

That’s the period leading up to commercial production on a mine, when investor excitement about a company’s looming ability to turn high gold prices into cash flow sends a stock soaring.

It’s proven to be one of the most reliable — and profitable — investing strategies in mining stocks.

| | But here’s the thing: West Red Lake is still trading at the levels of a pre-development company, which means there’s still time to get on board this story before it could go on a big run.

| | Take Frank Giustra’s backing of this company as your signal that the timing is right to do your due diligence on West Red Lake Gold Mines.

| | CLICK HERE

To Learn More about West Red Lake Gold Mines Ltd.

| | | | | © Golden Opportunities, 2009 - 2024

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $7,500. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

2117 Veterans Memorial Blvd., #185

Metairie, LA 70002

1-800-648-8411

| | | |