|

There are plenty of reasons to be excited about uranium right now.

|

And there are also sound reasons to be excited about the potential for vanadium as a high-tech energy metal.

|

So when you find one high-powered junior mining company that offers potential in both of these compelling sectors, it’s time to take notice.

|

That’s precisely the kind of potential that Blue Sky Uranium (BSK.V; BKUCF.OTC) has offered investors for quite a while.

However — as you’re about to see — some key catalysts are about to bring all this potential to the fore.

|

15 Years Of Pain Turning To Gain

|

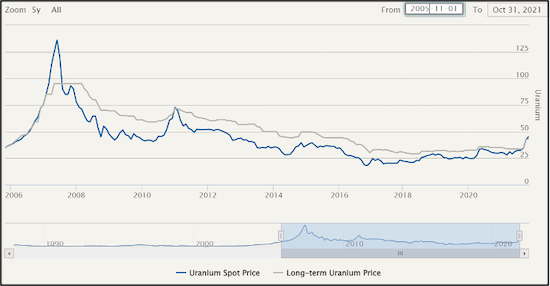

It’s been 15 years since the last true uranium rally in 2007, when the spot price hit $136 per pound U3O8.

Since then, there have been economic crises and market turmoil...highlighted by the Fukushima event of 2011 that was a leading trigger for a long-term decline in uranium prices due to decreased demand. Indeed, the uranium price eventually reached a low point of approximately $18/lb in 2017.

The spot uranium price was once again making a slow comeback after 2017, helped by production cut-backs by uranium miners reducing supply and the construction of new reactors in Asia and the Middle East increasing demand. The uranium spot price was hovering in the $27/lb. to $32/lb. range over the past summer...

…and then came Sprott.

If you need any evidence of a growing demand for yellowcake, look no further than the Sprott Physical Uranium Trust (SPUT).

|

|

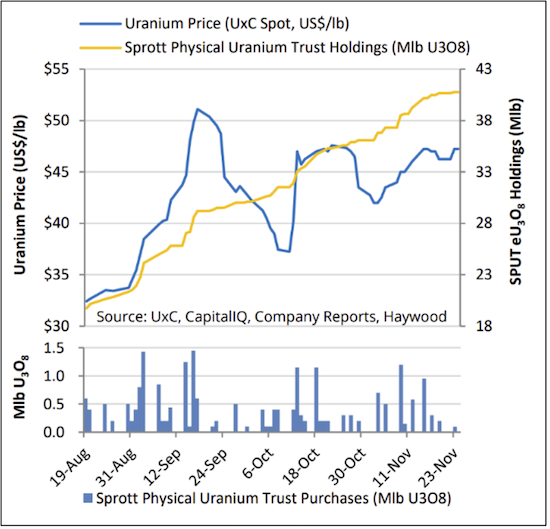

The Sprott Physical Uranium Trust (SPUT) began trading on the Toronto exchange in July 2021 and has purchased uranium nearly continuously on the spot market since then.

|

The fund has accumulated over 28 million lbs. of U3O8 (about one-eighth of the total yearly world demand) so far and claims no intention of selling any of its holdings.

|

The SPUT fund itself is currently at $2 billion with no sign of letting up until they reach a level of $3.5 billion…that buys a lot of yellowcake. As noted by Haywood Securities in November, “Investors continue to recognize the [fund’s] buying potential and potential knock-on effect on the uranium price.”

|

|

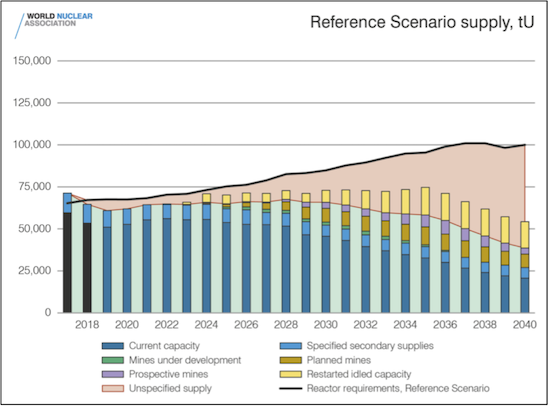

When you look at current levels of depleting production and the lack of new supply, it’s no surprise that Sprott is now all-in on uranium. From the chart below, we can see a nearly 25,000-tonne deficit by 2040. That new supply has to come from a much-beleaguered exploration industry.

|

|

And this all takes us back to Blue Sky Uranium, and its valuable project in Argentina...

|

An Enviable Uranium Resource — And Tremendous Upside

|

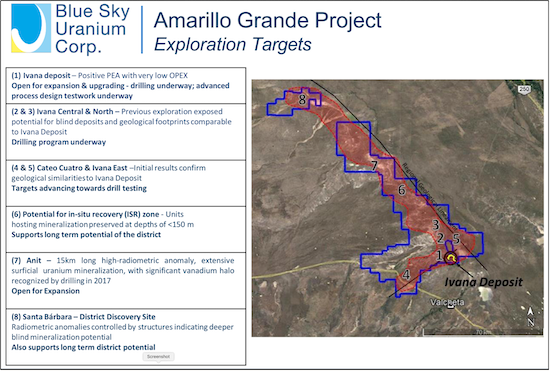

Blue Sky’s Amarillo Grande Project in Rio Negro consists of three major properties: the Ivana property (which features the current inferred resource of 22.7 million pounds of uranium and 11.5 million pounds of vanadium), the Anit property and the Santa Barbara property.

|

It’s important to realize just how big this project is. It truly represents not just a single deposit, but an entire district.

|

Consider that the Amarillo Grande Project incorporates a series of uranium-vanadium discoveries made over 15 years along a massive, 145-kilometer long by 50-kilometer trend covered by fully 300,000 hectares of mineral rights.

And over and above the current resource, this tremendous property is peppered throughout with key, identified targets for more mineralization.

|

|

| (Click image to enlarge)

The large Amarillo Grande project already boasts a major uranium and vanadium resource, but also boasts a number of identified targets that could expand the resources significantly.

|

But here’s another key: The mineralization at Amarillo shows characteristics of both sandstone-type and superficial-type (near surface) uranium deposits. About 41% of known deposits globally are sandstone-type deposits, most notably found in Kazakhstan, the source of about 50% of the world’s uranium production.

To put it into perspective, the Inkai mine of Kazakhstan is a sandstone-type deposit. Its 2010 proven and probable reserves totaled 244 million pounds of U3O8 — all at about the same grade as Blue Sky’s Ivana deposit, but at more than 10 times the size.

Due to the depth of mineralization typically found in these deposits, from 300 to 500 meters, in-situ recovery (ISR) methods are used to extract uranium contained in sandstone aquifers. In situ techniques involve circulation of solutions through ore-bearing formations to dissolve uranium and pump it to the surface for recovery. This approach results in minimal surface disturbance and produces no waste rock or mill tailings.

|

Conversely, mineralization at Amarillo Grande, while in the same style of fine material as sandstone-type deposits, is at much shallower depths of less than 25 meters.

That contrasts sharply with the 300-600-meter depths found in Kazakhstan, where deep in-situ recovery is required.

|

“The mine at the Ivana deposit would be more akin to a sand quarry, with no blasting, no crushing, and only wet screening required in the first stage,” says Blue Sky CEO Nikolaos Cacos. “By separating fine material from the course material you separate three-quarters of your volume, so your low grade virtually quadruples from the separation, pre-concentration processing, which is very, very low cost.”

And that’s the key to one of the most compelling aspects of Amarillo Grande....

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

|

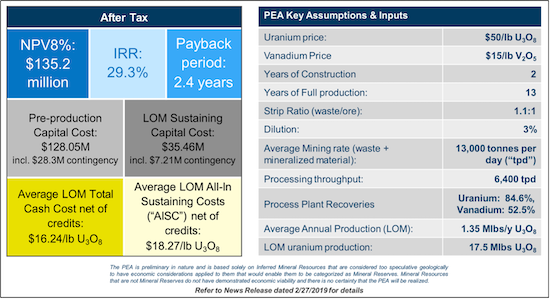

In 2019, at a relatively early stage in its exploration of Amarillo Grande, Blue Sky decided to perform a preliminary economic assessment (PEA) to determine the economic viability of mining the Ivana deposit.

The results validated their confidence in the project.

The Ivana PEA outlines a production rate of 1.35 million pounds of U3O8 per year at a mining rate of 13,000 tonnes per day, yielding an after-tax net present value (discounted at 8%) of $135 million. The after-tax internal rate of return is robust at 29.3%.

Perhaps the most impressive metric is a projected capital cost of just $128 million, including a $28 million contingency allocation.

|

“The total cash costs net of credits is $16.24 (per pound), within the lowest cost quartile in the industry,” says Cacos.

|

And because of the low-cost “sand quarry” type of mining, Blue Sky could mine a much larger resource without materially increasing their capital or operating costs.

Thus, newly discovered resources would simply turbo-charge these already-impressive project economics.

|

|

| (Click image to enlarge)

The preliminary economic assessment for Blue Sky’s Ivana deposit shows it could rank among the lowest-cost projects in the world.

|

The High-Tech Bonus Of Vanadium

|

The Ivana deposit features sandstone-hosted, surficial-type (near surface) mineralization hosted in carnotite, a bright to greenish-yellow mineral that occurs typically as crusts and flakes in sandstones.

|

The high uranium content makes carnotite an important uranium ore but, as with the Ivana deposit, it can also be an important source of vanadium.

|

According to Cacos, “at virtually no cost we can extract vanadium from near-surface carnotite, along with the extracted uranium. When you dissolve carnotite you at the same time dissolve the uranium and vanadium in the same process. The only thing you need to do is to precipitate/separate one from the other.”

In other words, the revenue from high-tech vanadium drops to the bottom line during the uranium processing. This is a valuable bonus that few other uranium producers could offer.

|

Drill Results Coming Up In Days

|

Blue Sky finds itself in an enviable position, with a PEA in hand showing outstanding economics for the project...and with additional resources simply adding to the projected bottom line.

“The second stage,” notes Cacos, “is to find more uranium, and that’s what we’re doing right now. We announced last spring a 4,500-meter drill program and have defined targets in a cluster within a 30-square-kilometer area....We’ve more recently doubled down and announced an additional 3,500 meters, which includes drilling just outside the Ivana deposit, where we believe there is room for expansion.”

|

First results from the current drill program are expected sometime in January, with continuous results released every few weeks thereafter.

|

In other words, as the uranium market continues to attract the market’s attention, Blue Sky will be releasing near-constant drill results over the weeks to come.

With outstanding economics, a major resource in hand and numerous new targets being drilled right now, Blue Sky Uranium is perfectly positioned to leverage the new uranium bull market.

The time to explore this opportunity is before the drill results start to come in.

|