| Will today mark the launching pad for gold? | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

The annual December Fed meeting has often served as a rallying point for the gold price.

With the Fed meeting ending today, yesterday’s big move higher shows that many are betting it’s going to happen again.

| |

Ahh…the year-end Fed meeting. A clarion call for gold bugs!

|

At least it has been, usually, since the pivotal Fed gathering in December of 2015.

|

As you may remember, that was when the Fed was widely expected to announce the start of a roll-back of its zero-interest-rate policy (ZIRP) and quantitative easing programs.

|

The process, Fed chair Janet Yellen assured us, would be as boring as “watching paint dry.” And at the eventual rate of just a quarter-point a year, it was just so.

But when they tried to accelerate the process, the U.S. equity markets firmly said “NO!” and the Fed drew back.

But that’s all beside the point I want to make today — which is about what all this meant for gold.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

| |

Ringing The Bell At The Bottom

|

Some may believe the old adage that “they don’t ring a bell at the bottom of the market,” but sometimes you can hear the faint echoes of just such a warning.

I did in the run-up to the Fed’s December 2015 meeting. At the time, all the pundits were talking about how the Fed’s tightening would be the death knell for gold.

I famously took the opposite tack, predicting that — like the “buy the rumor, sell the news” phenomenon — the actual event would release the selling pressure on gold.

And so it happened, as gold quickly began to rally following the Fed’s year-end meeting (and announcement of its rate-normalization campaign).

As you can see from the following chart, that rebound morphed into a seven-month rally that made us a lot of money in the undervalued junior mining share market.

|

|

And as you can also see, that mid- to late-December time frame subsequently marked an important time to be in gold and those junior mining stocks. If the December Fed meeting wasn’t the actual launching point (as in 2018), it was still pretty close.

Every other time, it clearly marked a turn-around point for the metal.

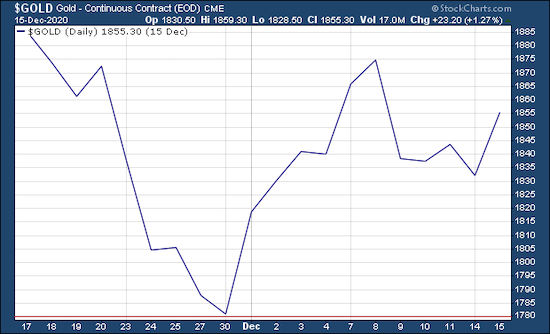

However, I don’t think that’s going to happen this time around. As you can see from the chart below, it looks like gold may have bottomed a bit early this year, on November 24th, when it hit the 50% retracement level of the rally since March.

|

|

And yesterday, after a few days of settling back from the big move off of that low, it jumped again. Gold gained $26.60 (1.46%) yesterday on a spot basis, and silver encouragingly outperformed with a big gain of $0.63 (2.62%). It’s held onto those gains today, with a gain of a few dollars as I write.

This is a sign that others are expecting the Fed meeting phenomenon to hold true again. If anything, this worries me…but given all the other factors working in gold’s favor right now, I’ll bet that the metal continues to gain ground this month as the first stages of a typical early-year bull run.

If that happens as expected, many of the junior mining stocks that are now still at very undersold levels could double or even triple within just a few weeks.

|

Once again, we detailed a number of the best opportunities in our special, year-end edition of Gold Newsletter.

|

Pushing 80 pages in length, this massive issue reviews 40 junior mining stocks and also features valuable excerpts from our recent New Orleans Investment Conference.

It alone is worth the price of a full-year subscription to Gold Newsletter, which itself is one of the best bargains in the investment industry.

You can subscribe, and get instant access to our year-end special edition, by CLICKING HERE.

Whatever you do, get involved in the sector now. History shows the starting gun has just fired for a new bull market in gold and mining stocks.

| All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

| | | |