| A Happy New Year for gold bulls…

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

…And — hopefully — a Happy New Year for gold investors.

| |

I’d like to wish you and yours a very Merry Christmas, a wonderful holiday season and a happy, healthy New Year.

|

If things work out as we expect, the new year will also be wealthy for those invested in gold, silver and the mining shares.

|

That’s because the Fed will finally attempt to reverse its ultra-easy monetary policies next year, and history (along with basic math) tells us they won’t be able to get too far along that path.

Their failure to tighten to any significant degree should launch gold to far higher levels, bringing silver and the mining stocks along with it.

However, while the future looks promising, we must recognize that we had similar hopes this time last year…and what a year it proved to be.

|  |

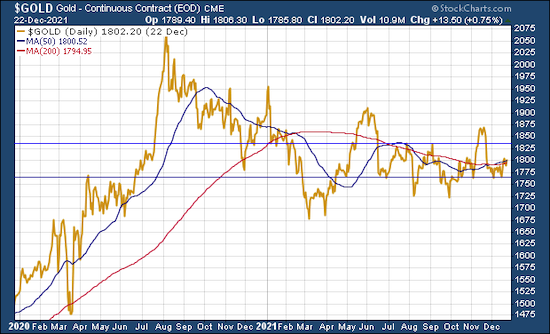

As you can see, 2021 has been a year spent digesting the crazy moves of 2020 that came after the emergence of the Covid-19 pandemic. We had hopes that the correction from the summer 2020 highs had ended last spring, but that rally was summarily quashed as the Fed shifted its rhetoric toward tightening.

We had a couple of rallies during the summer and fall that raised our hopes…but we couldn’t successfully break out of the $1,765-$1,835 trading range in either direction.

Now, however, we are approaching the resolution of the shift toward tighter monetary policy. The action of the past year is reminiscent of the same situation post-2008, and the resolution that time was very bullish for gold once the Fed attempted to tighten.

I expect the rally in gold will be much more pronounced this time around.

| |

Yes, the gold market has forced us to be patient this year, and is demanding more patience right now. If the past 12 months have taught us anything, it’s that the markets can be humbling. And that’s a good lesson for life in general.

|

Taking that lesson to heart as we approach the end of 2021, I am particularly humbled by, and grateful for, the support I and my team have received from all our loyal readers of Golden Opportunities and Gold Newsletter, along with attendees of our New Orleans Investment Conference.

|

I hope you feel we’ve brought you great value over the past year, and appreciate that your satisfaction is our highest priority.

To that end, I’m asking you to please let us know how we’ve done, and to share your ideas for how we can serve you better. Simply drop us an email at admin@jeffersoncompanies.com to let us know your thoughts and suggestions.

We know that you’re a smart, successful and skeptical investor by the very fact that you’ve sought out our insights, and for that very reason we want to hear from you.

In closing, please know that you and yours have our sincere, best wishes for a Merry Christmas, a wonderful Holiday Season, and a happy, healthy and wealthy New Year!

| |

All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | |

© Golden Opportunities, 2009 - 2021

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |