|

Dear Fellow Investor,

There's elation in a once-quiet corner of the commodities market.

And it spotlights what could be a significant — and surprising — profit opportunity for you.

You see, after a decade as mining's step child, zinc explorers saw a significant revival in 2017, as worldwide zinc prices rose 21%1. Moreover, Industry experts say that increased demand from a number of industries means zinc will remain bullish through 20222.

Consider that zinc is lightweight and rustproof, which makes it attractive to car makers, steel makers, and the construction industries. But there is also a growing consensus that, because it's so lightweight and plentiful, zinc could challenge lithium as the core of a new class of long-lived batteries.

Miners are racing to take advantage. After a glut that had driven prices down 66% from zinc's peak in 2006, prices are nearly back to that level again3.

The biggest zinc producers like Nyrstar (NYRSY.OTC) are definitely in the mix. But many other miners that also reap zinc alongside other metals are benefitting as well, especially Teck Resources (TECK.NYSE) and Glencore (GLCNF.OTC).

Glencore has already seen its price jump 38% in the past year. Teck is up 41% in the last year. The large companies have done well — the stock market has already rewarded them justly.

But we believe that for pure upside potential, Blue Moon Zinc (MOON.V; BMOOF.OTC) is the most promising zinc play on the market. (Recent record trading volume around 10 cents suggests investors are beginning to wake up to that fact.)

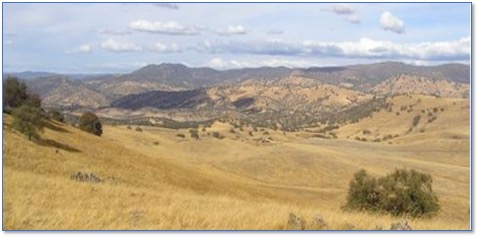

And it's working in a most surprising place: Mariposa County, California.

Investors can easily anticipate how rising zinc prices will be a boon for a small company like Blue Moon, but the world really didn't see the California angle coming.

However, that location means small, smart Blue Moon has easy access to a large battery maker that stands ready to use all the production the company can bring to it.

California is known as an environmentalist's paradise and a miner's headache. But the surprise is that the popular image isn't entirely right. Mariposa County is sparsely inhabited and friendly to miners who bring jobs. And Blue Moon will have legendary miner Lutz Klingman, who knows California intimately, to guide it.

Higher Prices Seem Here To Stay

This is just the beginning curve of a long increase in demand for zinc...and Blue Moon. Robin Bhar, Société Générale's head of metals research, believes that among the base metals, zinc has a particularly low supply in relation to its oncoming demand4.

He's not alone with a rosy outlook. Wood Mackenzie, a commodities-industry consultancy, estimates prices averaging $3,500 a ton between 2018 and 20205.

Despite this projection for a 66% gain in zinc prices since 2013, the large miners have decided to hold back on expanding their production of the metal. Teck has hardly increased its zinc production over the last five years6. Glencore, which shut down a third of its production two years ago, is finally restarting some of its zinc mines, but it may be 2020 before they add to their output7.

This means that as demand rises, smaller, more nimble Blue Moon Zinc (MOON.V; BMOOF.OTC) should get its zinc to market quickly in order to take advantage of the big jump in the price per ton this year. And next!

Breakthrough Battery Technology Means New Demand

And while the big players have established supply lines to heavy zinc users such as Chinese automakers and electric vehicle manufacturers, it's an exciting new and novel use of zinc that could push Blue Moon and other zinc miners much higher.

That's because an innovative Canadian company has made what looks to be a significant breakthrough in battery technology. And it could shake up not only the energy industry, but also the global demand for zinc.

ZincNyx Energy Solutions has developed and patented a unique "flow battery" technology that uses a combination of zinc and air as fuel. And we're talking about big batteries — batteries that can store energy from wind and solar sources, power entire off-the-grid remote facilities and power cell phone towers.

ZincNyx is looking to ramp up production in order to make 1,000 units this year. For the same 20-kilowatt per hours output, the zinc flow batteries will cost at least $40,000 less than an equivalent system from Tesla8, Elon Musk's forward-looking company.

The ZincNyx systems could be built to deliver up to 100-Kw per hour.

But it will need plenty of zinc. And that favors smaller, U.S.-based zinc assets such as Blue Moon Zinc.

Blue Moon Zinc is expected to start drilling its zinc resource shortly to further define and expand the mineralization. Following its drilling campaign, the company expects to complete a Preliminary Economic Assessment (PEA) for the advanced-stage project — essentially an engineering study and projection of potential economics.

The good news is that not only have U.S. corporate tax rates been slashed, but the Blue Moon property is located on gentle terrain, near roads, ports and labor supplies. That offers the ability to move forward rapidly.

But what distinguishes this high-potential mine from other U.S.-based mines is that Blue Moon is incorporated in Canada. This is a vital distinction that favors all commodity investors.

Highly Regulated Market Favors Investors In Junior Miners

Because it is Canadian-based, with a U.S.-based office and U.S.-based staff, Blue Moon must file a legal document known as a NI 43-101 Mineral Resource estimate. Then, regulators review the document for its veracity.

That makes Blue Moon Zinc more transparent and credible than many startup small mines that suddenly decide to see if they can turn a new trend to their advantage.

Blue Moon made its most recent NI 43-101 filing on November 13, 2017 on https://www.sedar.com/9, and it suggests that the California zinc resource estimates could be substantial:

• 3.7 million tons at a grade of 8.3% zinc equivalent, for approximately 377 million pounds of zinc in the Indicated category

• 4.1 million tons with a grade of 7.8% zinc equivalent, for approximately 395 million pounds of zinc in the Inferred category

• Significant bi-products of copper, silver and gold.

Mariposa + Klingman = Unique Advantage

As with most real estate or mining ventures, location is critical. When it comes to infrastructure that's doubly true for mines.

The news is good here. Blue Moon's Mariposa County property is accessible today by gravel roads off nearby paved highways. The main power lines and a hydroelectric power generation facility are both within one mile of the property. Sea ports, rail and trucking routes are all accessible.

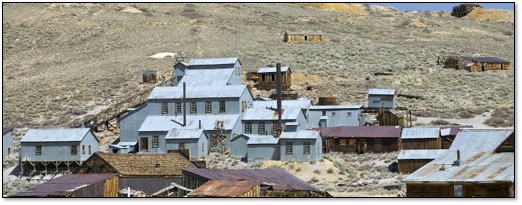

The mine has a rich history, as it was most recently worked by Imperial Metals (III.V), Boliden (SEK, Nasdaq, Stockholm) and Barrick (ABX.NYSE) in the 1980s and 1990s.

Blue Moon has brought legendary miner Lutz Klingman out of retirement to guide its California operation.

Klingman developed the Golden Queen mine in Soledad, CA, and oversaw all its environmental studies and permitting. The company is confident that, with Klingman, it will manage the permitting process in California successfully.

Blue Moon Zinc also has another large zinc property to its credit. Known as the Yava Property, it's a five-square-mile property in the Mackenzie Mining District of Nunavut Territory, Canada, about 289 miles northeast of Yellowknife.

But, for the here and now, when it comes to Blue Moon (MOON.V; BMOOF.OTC), it's U.S. zinc property is the name of the game. With the burgeoning zinc battery market, the news is exceedingly positive for this young company.

Six Reasons to Buy Blue Moon Zinc (MOON.V; BMOOF.OTC)

For Potentially Outstanding Share-Price Growth In 2018.

1)Demand! There is no question worldwide demand for zinc is soaring.

2)Strong, Rising Zinc Prices. The price per ton for zinc is nearly $3,500, which is record breaking.

3)Supply Restrictions. Major players, such as Glencore, have been unable or unwilling to expand production to meet surging demand.

4)Buyer Ready. Small users such as ZincNyx Energy Solutions, with its patented zinc-based breakthrough battery technology, won't get a price break from the likes of Glencore, which doesn't need new customers.

5)Size Multiplies Effect. 377 million pounds of zinc in the Indicated category (3.7 million tonnes at 8.3% zinc equivalent) plus 395 million pounds of zinc in the Inferred category (4.1 million tonnes at 7.8% zinc equivalent) may not be that big of a deal for established miners such as Glencore and Teck, but it's a fortune-maker for a young company like Blue Moon with stock trading at 10 cents and a market cap of only about $10 million (Feb. 2018).

6)Near Term. As Blue Moon advances its business plan and moves toward feasibility, permitting and ultimately construction, this company should capture huge attention from hard asset investors.

Look At Blue Moon Mining Today

At this very moment, major media, including the vaunted Wall Street Journal, are beginning to report on the accelerating bull market in zinc.

Millions of investors are learning about this global investing trend.

This is why serious commodity investors should move now and consider Blue Moon Zinc (MOON.V; BMOOF.OTC) while its shares are still at attractive levels.

Late-Breaking Note: Noted analyst David Morgan just conducted a video interview with Blue Moon's CEO at the world's largest mining conference.

CLICK HERE to view this superb summary of Blue Moon's key market advantages….

1https://investingnews.com/daily/resource-investing/base-metals-investing/zinc-investing/zinc-outlook/

2https://nbpostgazette.com/2018/02/06/united-states-metal-zinc-market-to-grow-as-united-states-metal-zinc-heats-up/

3https://www.lme.com/Metals/Non-ferrous/Zinc#tabIndex=0

4https://www.foxbusiness.com/features/2017/08/16/zinc-prices-hit-10-year-high.html

5https://www.foxbusiness.com/features/2017/08/16/zinc-prices-hit-10-year-high.html

6https://www.teck.com/investors/five-year-production/

7https://www.ft.com/content/a25ae13c-e011-11e7-a8a4-0a1e63a52f9c

8https://www.greentechmedia.com/articles/read/zincnyx-plans-flow-battery-mass-production-within-a-year#gs.=bVHgjo

9https://www.bluemoonmining.com/projects/blue-moon-usa/

|