|

Dear Fellow Investor,

In this issue, I'd like to share the latest thoughts of one of my favorite gold analysts, Martin Murenbeeld.

You've likely heard of Dr. Murenbeeld over the last couple of decades, as he's occasionally shared his in-depth research on the gold market and global economic trends. But you haven't seen his work often by any means, because he's typically worked only with top-level institutions as their in-house economist.

Well, Dr. Murenbeeld and his research team have recently launched a service that provides his institutional-level research to individual investors. To help introduce his service to our readers, I asked his team to provide a sample of their latest views for you here.

- Brien Lundin

Key Reasons Why The Dollar Is Headed Lower — And Gold Is Headed Higher

Note: Murenbeeld & Co. is a spinout of DundeeEconomics from parent company Dundee Corporation, which was founded by investment and gold mining legend Ned Goodman. This spinout company now publishes research on a paid subscription basis for mining company clients and asset management clients. As a service to Brien Lundin's readership we summarize here some of the key reasons the dollar will likely continue to weaken over the next several years (at a minimum) and how gold is likely to respond to global economic risks outlined by the World Economic Forum.

U.S. Dollar Weakness

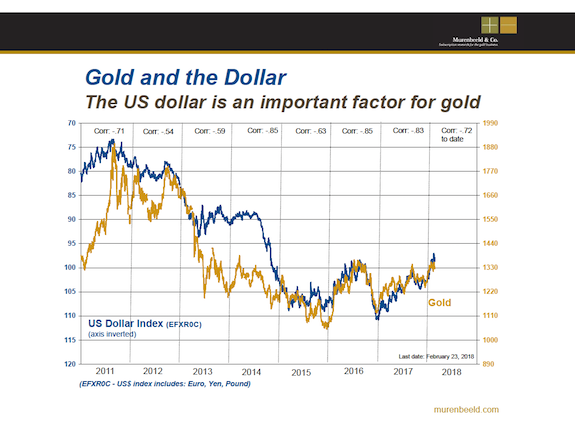

The dollar price is inversely correlated to the gold price (when the U.S. dollar weakens, the gold price generally goes up). The chart below shows the correlation of the U.S. dollar and gold price each year back to 2011. The U.S. dollar has been on a weakening trend since the beginning of 2016, below are key reasons that the trend is likely to continue.

• Lack of foreign demand for U.S. Treasuries — less foreign exchange market interventions to suppress non-USD currencies (in pursuit of export growth) will mean lower demand for reserves of USD to be held by foreign central banks. And rising long-term U.S. yields create the possibility of substantial trading losses for central banks holding American issued debt obligations.

• Strong foreign growth — shifts investment flows from U.S. to overseas markets ("The dollar's descent is not so much a judgment on America's fitness as a sign of the burgeoning health of other places" notes The Economist, 01/18).

• Politics — the Trump Administration wants a lower dollar.

• U.S. protectionism — foreign countries can best counter/overturn U.S. protectionist legislation by letting their currencies rise against the dollar, which is seen by Americans as a falling dollar.

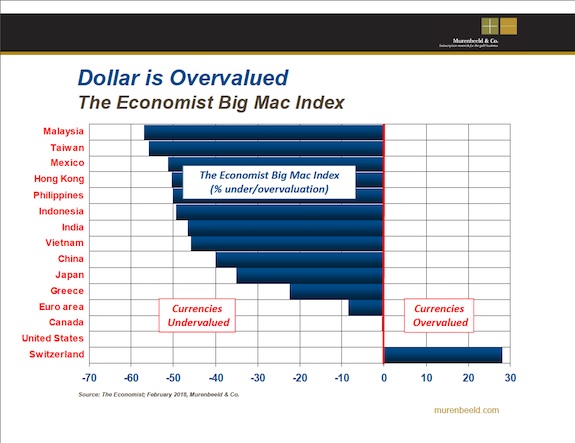

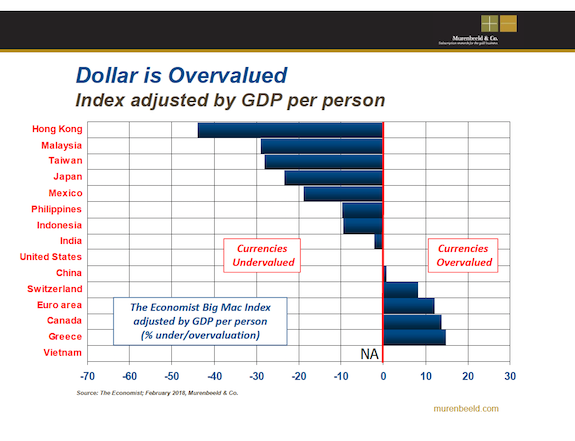

• Overvaluation — the dollar is fundamentally overvalued. To drive this point home we highlight the Economist's recently updated Big Mac Index — see charts below.

(The Economist notes: The Big Mac index was invented in 1986 as a lighthearted guide to whether currencies are at their "correct" level. It is based on the theory of purchasing-power parity - PPP, the notion that in the long run exchange rates should move towards the rate that would equalize the prices of an identical basket of goods and services (in this case, a burger) in any two countries. For example, the average price of a Big Mac in America in January 2018 was $5.28; in China it was only $3.17 at market exchange rates. So, the "raw" Big Mac index says that the yuan was undervalued by 40% at that time. This can be seen in the top chart.

"Burgernomics" was never intended as a precise gauge of currency misalignment, merely a tool to make exchange-rate theory more digestible. Yet the Big Mac index has become a global standard, included in several economic textbooks and the subject of at least 20 academic studies.)

Golden Opportunities continues below...

|

Sponsor:

The Murenbeeld & Co. Gold Monitor:

One-Year Subscription — (50% Off!)

$198.00 $99.00

Get the gold-market research that many of today’s biggest institutions are paying for.

Murenbeeld & Co. knows the best way for investors to make money in gold is to get the commodity right. We study, map, and predict gold prices. Our only concern is getting the gold price correct. This is how we serve you.

Dr. Murenbeeld has been analyzing the gold market for over four decades. Our weekly Gold Monitor is quantitatively driven, with analysis that only many years of closely monitoring the market can provide. The Gold Monitor focuses on the long-term factors that matter to the gold price, without the distraction of the short-term noise. Our approach outlines the current bullish and bearish factors driving the price then ranks them to the most prevalent. We update these factors each quarter in our scenario-based gold price forecast.

If you’re interested in getting the same gold-market research that many of today’s largest institutions rely upon, click on the link below to start your subscription today.

|

Global Risk

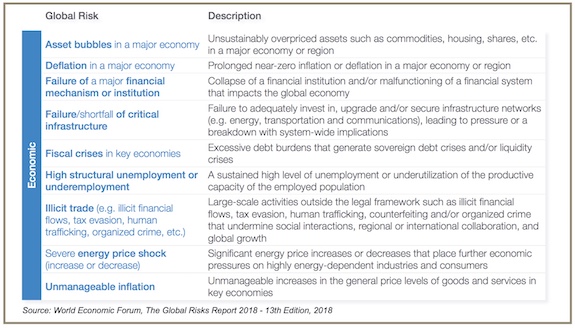

Gold often appreciates during times of chaos in the economic/financial environment. With that in mind we looked at the latest report from the World Economic Forum on global risks. It's a very depressing read. The list of economic risks identified in the report is summarized in the table below (but there are also lists of environmental, geopolitical, societal, and technological risks for those who want the "full Monty" of risks).

Some thoughts on the impact of these risks on gold:

• Asset bubbles — implosions are invariably followed by recessions/depressions. The latter beget expansionary monetary and fiscal policies (QE-X, massive budget deficits, etc.). Gold declines when bubbles implode, then surges in response to the expansionary policies.

• Deflation — will inevitably be countered with very expansionary monetary policies (note recent Bank of Japan, ECB, and Fed responses). Monetary policy responses are typically positive for gold — though deflation itself is not positive for gold.

• Bank failure — will also be countered with expansionary monetary policies (central banks are lenders of last resort, remember). Bank failures are positive for gold.

• Infrastructure failure — such failures could go either way for gold. The affected economy will drift into a slower growth pattern from one generation to the next — each generation enjoying less economic well-being than the previous generation. (In my opinion, the U.S. is at the cusp of massive infrastructure failure; welfare has replaced infrastructure!) A fiscal response to infrastructure failure risks overheating the economy, widening budget deficits, and boosting inflation — which are typically more positive developments for gold.

• Fiscal crises — these crises could also go either way for gold. Since the Great Depression monetary policy has come to the rescue of government fiscal stress (lest another depression unfolds); prior to then government financial stress/bankruptcy led to severe recessions or depressions. We can safely assume monetary policy (the central bank) will bail out its government during a fiscal crisis — meaning gold will benefit.

• High Unemployment — need we note here that the Federal Reserve's first objective is "maximum employment"? Central banks do not normally tighten policy when unemployment is elevated (and were inflation to be excessive at such times the authorities in western economies have tended to adopt wage and price controls). High unemployment without a policy response is not positive for gold, however.

• Illicit trade — probably favors gold. Gold has historically served as the medium of exchange in illicit trade, which is one reason there is lack of transparency in some far corners of the gold market.

• Energy shocks — lower energy prices are typically negative for gold, because it not only reduces the wealth of a very few ultra-wealthy individuals (Mid-East, Russian) who have a penchant for keeping wealth in "untraceable" assets (of which gold is high on the list), but low energy prices also depress posted rates of inflation. Higher energy prices do the opposite and will raise CPI in the large consumer economies. (It wasn't an accident that gold rose sharply in the 1970s right along with the sharply higher energy prices courtesy of OPEC!)

• Unmanageable inflation — this is a slam dunk for gold. Has anyone noticed what gold might be doing in Venezuelan bolivars? (February 23 Bloomberg quote: $1.00= 28,965 bolivars — watch out Zimbabwe!)

In summary, our long-term outlook for the gold price is bullish. The weakening U.S. dollar and increased economic/financial risks are two factors that that go into our gold price forecast, which is updated quarterly.

(Editor's Note: I highly recommend Murenbeeld & Co.'s institutional-level research. To introduce their service for individual investors, they've agreed to allow Golden Opportunities readers to subscribe at half price — just $99/year — for a limited time.

CLICK HERE to take advantage of this opportunity while it lasts.

— B.L.)

|