| This is the best place to find gold… |

|

| Please find below a special message from our advertising sponsor, Meguma Gold. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports. |

|

Applying a new model to an old gold camp allowed Atlantic Gold to turn a grassroots exploration play into a C$722 million buyout windfall.

Now, tiny MegumaGold (NSAU.CN; NSAUF.OTC) has positioned itself to be the next big takeout — amassing a huge land position in the district...with properties right next to the gold deposits that made Atlantic’s buyout possible.

|

|

The best place to find gold is where you’ve already found it.

|

|

It’s a cliché in the gold industry because it so consistently turns out to be true.

Once a trend of mineralization has been established, the likelihood goes up that more gold will be found on that trend.

|

This is more than a cliché — it’s a way to make money in junior mining. A lot of money.

|

Case in point: Atlantic Gold.

In 2015, this small junior began securing a large land position along the Meguma formation in Nova Scotia. They had the idea that the typical high-grade, vein-hosted deposits in the region could actually be exploited as larger, lower-grade, open-pit deposits.

|

Atlantic went on to prove up a multi-million-ounce gold resource spread over four deposits — and then sold that resource and the mining infrastructure on its Touquoy deposit to St. Barbara Mining for an eye-popping C$722 million.

|

And while Atlantic was readying its assets for sale, the next player began to emerge: MegumaGold Corp. (NSAU.CN; NSAUF.OTC) began quietly staking positions along key trends in the area. Before most realized what was happening, MegumaGold had already amassed a huge land position.

And this wasn’t just land for the sake of land. As you’re about to see MegumaGold used its understanding of the area geology to secure land along the key structures in the region...including property adjacent to and on strike from Atlantic’s deposits.

This is important because the proximity of several of its projects to Atlantic’s (now St Barbara’s) deposits gives MegumaGold the opportunity to quickly convert drilling success in to salable assets. (More on this in a moment....)

In short, MegumaGold has set itself up to be the next multi-bagger play on the revival of the Meguma formation as a major gold district.

|

New Life For A Historic Gold Camp

|

That revival started with Atlantic’s decision in the mid-2010s to accumulate a land package that included the Moose River Consolidated mine complex and a series of associated projects.

Those projects included the Touquoy (Moose River), Beaver Dam, Fifteen Mile Stream and Cochrane Hill targets.

Atlantic’s management team took a fresh look at the Meguma formation that hosts these properties.

The difference? Instead of focusing on the high-grade (but narrow) veins of gold that had historically been mined in the area, Atlantic began drilling its projects with the goal of proving up lower-grade disseminated material between the veins that could be mined via open-pits.

| |

| | Atlantic Gold’s Model For Gold Disseminated Mineralization Gets Results |

For proof of how successful that effort was, one need only glance at the table above.

It shows the historic, vein-hosted production on Atlantic’s projects and the resource increases made possible by targeting the surrounding, disseminated mineralization.

|

|

A String of Pearls Leads To A Takeout

| Simply put, Atlantic outlined a series of open-pittable gold deposits, all within trucking distance of the Moose River Consolidated (“MRC”) complex at Touquoy.

It was as if the main geologic structure in the region — an “anticline” — hosted a string of pearls, with gold deposits dotted along this key structure.

Thanks to an aggressive drilling program, Atlantic did a bang-up job of both proving up its resources within the Meguma formation and getting mining restarted at the MRC.

That mining operation shot out of the gate as one of the lowest cost operations in North America and attracted the interest of Australian miner St Barbara.

St Barbara’s C$722 million takeout of Atlantic Gold last year stands as one of the most lucrative exits in the junior gold sector’s recent history.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

Meguma Snaps Up The Remaining Pearls

| Now Meguma Gold is looking to become Nova Scotia’s next big success story.

It starts with the huge, 107,114-hectare land position Meguma has staked in the region. Those properties cover an eye-popping 466 kilometers of gold-prospective anticlines.

Simply put, there’s not another company operating in Nova Scotia with better access to the fault structures that have hosted the “string of pearls” deposit model established by Atlantic.

| |

|

|

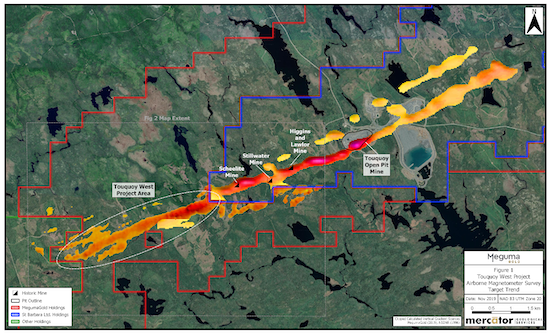

| A Massive Land Position Along The “String Of Pearls” | As the beige areas in the map above indicate, MegumaGold has staked out key positions around all the major deposits outlined in the area, including Touquoy, Beaver Dam, Fifteen Mile Stream and Cochrane Hill, along with Osprey Gold’s Goldenville and Caribou targets.

This is a district-scale play, one that could help convert this area of Nova Scotia into a new disseminated gold district, just as the discovery of disseminated gold along Nevada’s Carlin Trend in the 1960s transformed the state into one of the world’s key gold mining districts.

|

Growth Through Exploration And Acquisition:

A Big Deal Gives Meguma A Large Gold Resource

Plus Tremendous Exploration Potential

|

The proximity of many of MegumaGold’s projects to the MRC mining complex gives the company a ready-made buyer of any ore it defines on those projects.

One project that will certainly see drilling in the near future is Touquoy West, which sits on the MRC’s western side.

|

Touquoy West lies along the same anticlinal structure that hosts Touquoy, Beaver Dam and 15 Mile Stream.

|

A 2018 geophysical survey flown over Touquoy West indicates a favorable structural corridor and host sequence very similar to that which hosts the mine at Touquoy.

Meguma followed up that work with a 2020 induced polarization study that, along with soil geochemistry, identified three high-potential drill targets.

| |

| | Touquoy West Lies Directly Along Trend From St Barbara’s Touquoy Mine |

But as good as it may be, the exploration potential is just one advantage MegumaGold brings to the table.

As the major junior player in the region, Meguma is the natural vehicle to consolidate the best land remaining.

|

Case in point: MegumaGold just inked a definitive agreement to acquire Osprey Gold.

|

This deal will bring Osprey’s key Goldenville, Mitchell Lake and Caribou projects into the fold.

But get this: Meguma will not only get the exploration upside from those projects...but also Goldenville’s 447,000 ounces of inferred gold resources to build on.

Adding to that value is the good work Meguma has done on the southern portion of the Meguma trend.

Its Killag project there has already seen a 20-hole, 1,600-meter drill program in 2019 on the Killag East target. That program turned up anomalous, disseminated gold along a full kilometer of strike length — a significant discovery in this region.

| Nova Scotia’s Next Gold Takeout?

|

A lot of investors were kicking themselves for missing the Atlantic Gold story. And for good reason — big winners like that don’t come along every day.

But imagine how they’ll feel if they miss the second act in the story?

Given the proven repeatability of open-pittable gold deposits along this formation and Meguma Gold’s commanding land position in the region, this company is giving us another bite at the apple here.

|

Consider that St Barbara’s Touquoy operation is currently running out of ore and permitting issues are holding up its access to the Cochrane Hill deposit.

|

Also: Meguma’s management team is committed to drilling its projects — particularly those on-trend with St Barbara’s operations. So lots of exploration news flow in the interim, regardless of the potential take-out story.

With only an C$11 million market cap...a tight share structure...a clear path to growth via exploration and acquisition...and a land position that seems perfect for a major mining company’s operations, MegumaGold looks like a solid speculation in a gold bull market that’s still in its early innings.

Because the best place to find gold is where you’ve already found it.

|

|

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $7,500. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

|

|

| |