The Great Debate: Michael Larson on Optimists versus Pessimists

Fergus Hodgson, 17 August 2016 ![]()

![]()

![]()

Michael Larson has written that he “can’t remember seeing such a wild split in views on so many different markets.… One side argues we’re heading into a recession. The other argues the economy is heating back up.”

This standoff is ripe for examination, and we invited the editor of the Safe Money Report on the show to explain what has given rise to the divergent outlooks. Larson will also speak at the upcoming New Orleans Investment Conference in October.

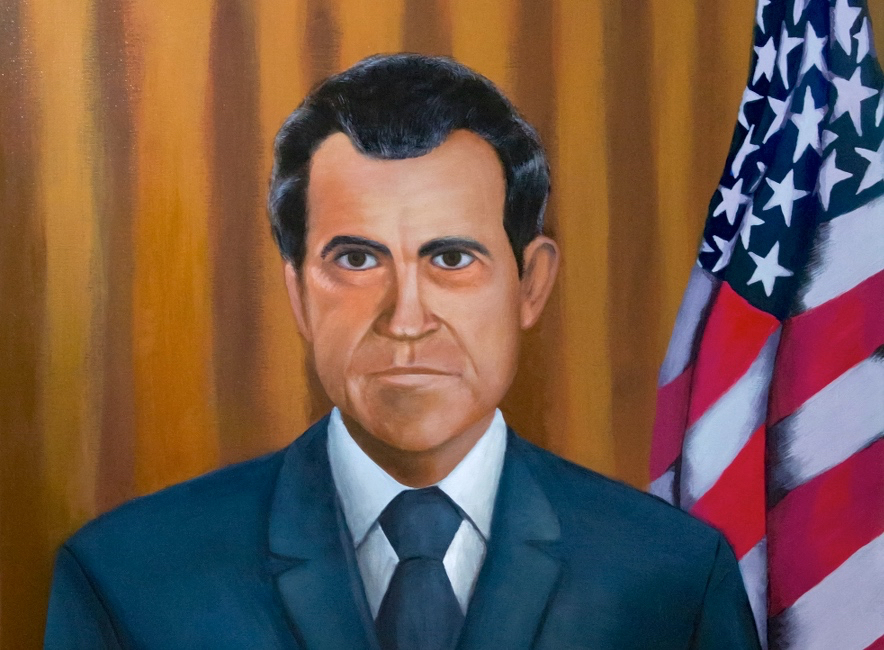

Perhaps the most notable term he uses is the “everything bubble,” which describes his view that there is exuberance and excessive debt financing across many asset classes. This week happens to be the anniversary of the closing of the gold window by President Richard Nixon in 1971, and both co-host Brien Lundin and Larson agree that this severing enabled the negative real interest rates of this era, accounting for the impact of inflation.

President Richard Nixon closed the gold window in 1971, and opened the floodgates for currency devaluation. (Source: Steve Fine)

Recommended Links

- “Great Debate Rages on Rates, Gold, Dollar, and More” by Michael Larson in Money and Markets.

- Exchange-Traded Fund (ETF) on Investopedia.

- Rollback: Repealing Big Government before the Coming Fiscal Collapse by Tom Woods (242 pages, Regnery Publishing, 2011). This includes an extensive section on the business cycle.

- The Real Crash: America’s Coming Bankruptcy by Peter Schiff (464 pages, St. Martin’s Press, 2014).

- “Today in 1971: President Nixon Closes the Gold Window” by Paul-Martin Foss with the Mises Institute.

Fergus Hodgson (@FergHodgson) is an economic consultant and Gold Newsletter‘s digital-media director.