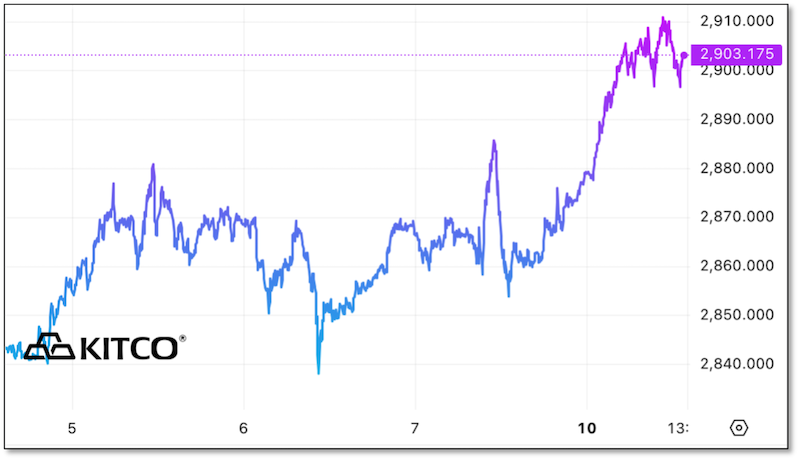

| Gold’s off to the races, again... | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | | Contact Us | Privacy Policy | View in Browser | Forward to a Friend | | .png) | | Off To The Races...Again | | | Gold’s powering higher once more today, with many crediting Trump’s new round of tariffs.

But there’s much more than that afoot. | | February 10, 2025

Dear Fellow Investor, | | My last letter was entitled “Gold Wants $3,000” — a lead off that prompted stern warnings from some loyal readers. | | “BRIEEEEN! Please don't do that! Tempting fate, eh?,” admonished one long-time fan. | | It just shows you how superstitious gold bugs like us can become, especially after many years of having our newly risen hopes dashed by vicious market sell-offs. | | Well, I call ‘em as I see ‘em...and gold has vindicated my view in the days since that headline ran. As I’ve been saying, gold “wants” to go higher, and the next big target remains $3,000. |  | | Granted, I was a bit worried when gold spiked $30 higher on Friday, only to have those gains quickly wiped out by new tariff rhetoric from President Trump.

But note that it is that same tariff rhetoric — claims of 25% tariffs on steel and aluminum, as well as reciprocal tariffs on most countries — that is being credited for driving gold up about $40 in today’s trading. No, there is much more afoot in gold right now... | | A Golden Symphony | | All of this tariff talk is merely a distraction — short-term noise amidst a veritably symphonic gold bull market — one driven by beautiful notes from an array of market drivers.

On one hand, we have the upcoming tsunami of Treasury debt — nearly $10 trillion worth — that’s set to be rolled over at much higher interest rates this year. This has led jittery investors around the world to buy gold in recent months and weeks. (See the chart featured in our last Golden Opportunities.)

And I can’t be too dismissive of the nascent trade war, with punitive tariffs on Mexico and Canada postponed for a month, but the 10% levies on China already taking effect and spawning retaliation. Trump’s comments that he’ll soon impose 25% tariffs on some industrial metals naturally has many worried that he’ll do the same with our favorite monetary metals.

I believe a much bigger factor than that, however, is the growing talk that Treasury Secretary Scott Bessent is pushing for a revaluation of U.S. gold reserves from their current $42/ounce to something approaching (or exceeding) current market values. | | As you know, this idea has been talked about for decades, but has been given little...currency...by our Fed and Treasury economic masters who would rather diminish the role of gold in today’s financial system. | | But there’s a new sheriff in town. And if the Trump administration revalues U.S. gold reserves, it would yield the Treasury an instant balance-sheet boon of nearly $1 trillion.

So you can see the attraction of the strategy. For us gold bulls, it would also be an immediate validation of gold’s true role as money...and the implications are already having an effect on the gold price.

Behind all of this, we still have the seemingly insatiable demand from official sources. The World Gold Council just reported that central banks, for the third year running, bought over 1,000 tonnes of gold in 2024, and that’s not counting the massive, unreported purchases from China, as intrepid analyst Jan Nieuwenhuijs has reported.

And then, finally, there’s what can only be described as turmoil in the London and New York gold markets, as the flood of metal being sent from London to Big Apple vaults to evade potential tariffs is masking cracks spreading in the paper gold edifice.

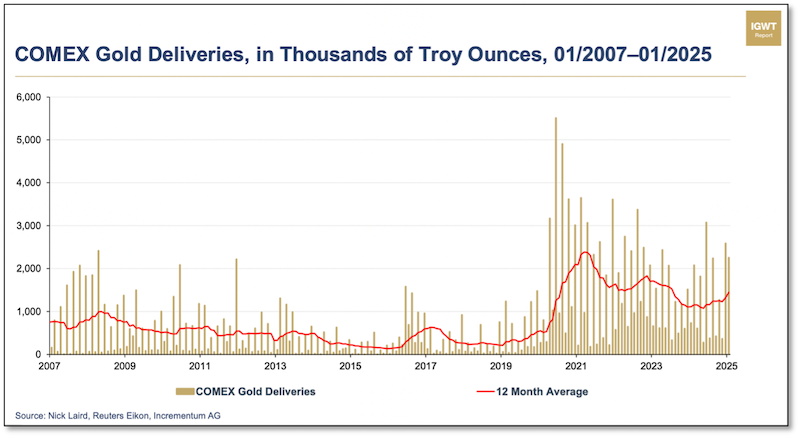

I received a note on this last week, with the accompanying chart, from our friends at Incrementum AG, publishers of the invaluable In Gold We Trust report. After decades of seeing similar predictions of imminent crisis in the paper gold market, Ronnie Stoeferle’s cautious note is something I entirely agree with: | | “At the time of writing, there are also many rumours about a ‘gold squeeze’ circulating, with physical gold inventories worldwide seemingly running low on physical stock. We always urge our readers to be cautious of rumours and overstated or misleading claims. That being said, gold deliveries are elevated and something is going on.” |  | | All this said, there’s no doubt that the vaults of the London Bullion Market Association and the Bank of England, as well as the Comex, are now being drained. As discussed last issue, the wait time for gold delivery from the Bank of England has gone from days to weeks, putting the staid institution in technical default on its obligations.

So I also value the input of noted analyst Alasdair Macleod, who noted last week that...

| | “Comex premiums, which have driven the arbitrage whereby gold has been airfreighted to New York in substantial quantities have subsided. But the increased pace of futures encashment for physical evidenced by stand-for-deliveries is irrefutable evidence that the paper market is being undermined by a flight into bullion. Given that the expansion of paper has diverted demand from bullion in the past, and that the bullion banks which offer unallocated accounts in London almost certainly are technically short, it would appear that the days of unbacked credit determining the spot gold price are drawing to a close.” | | Again, while we’ve heard this before, something is definitely going on...and it’s helping to drive the recent rally in gold.

More good news: This time the mining stocks are finally leveraging gold. As you can see from the following chart of the GDX:Gold ratio, the miners have been consistently outperforming the metal since late last year. |  | | That outperformance in the producers has been mirrored in the juniors, although this subsector remains ripe with significantly undervalued opportunities.

I just pinpointed two of the best opportunities in our February issue of Gold Newsletter. These are exciting new recommendations, and are featured among over 20 companies I cover in this issue.

In addition, I report on the fundamental drivers behind this historic new bull market in gold, silver and mining stocks, and give a glimpse into the even greater gains I expect over the next few years. | | If you’re not already a Gold Newsletter subscriber, I can’t emphasize strongly enough the opportunity that you are in danger of missing. | | We’ve literally waited decades for another big metals and mining bull market...and there are potentially life-changing gains ahead as the miners catch up to the metals.

Just click on the link below to learn more, and to make sure you don’t miss this generational opportunity. | | All the best, |  | | Brien Lundin

Publisher, Gold Newsletter

CEO, the New Orleans Investment Conference | | CLICK HERE

To Subscribe To Gold Newsletter Now | | CLICK HERE to watch interviews by Brien Lundin and Kai Hoffmann with many of today's most exciting junior mining companies on the Gold Newsletter Youtube channel. | | | | | | © Golden Opportunities, 2009 - 2025 | | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

2117 Veterans Memorial Blvd., #185

Metairie, LA 70002

1-800-648-8411 | | | |